A Process Cost Accounting System Is Most Appropriate When

A variety of different products are produced each one requiring different types of materials labor and overhead. A variety of different products are produced each one requiring different types of materials labor and overhead.

Which Of The Following Would Be Accounted For Using A Job Order Cost System In 2022 Accounting Job System

The focus of attention is on a particular job or order.

. After all the expenses are identified they are added up. Similar products are mass-produced. When a company produces multiple jobs within the same accounting period.

A process cost accounting system is most appropriate when A. The focus of attention is on a particular job or order. A process cost accounting system is most appropriate when A.

The organisation can use this method to identify the relevant costs Relevant Costs Relevant cost is a management accounting term that describes avoidable costs incurred when making specific business decisions. Individual products are custom made to the specification of customers. 18 rows A process cost accounting system is most appropriate when.

Process cost systems are used to apply costs to similarproducts that are mass-produced in a continuous fashion. The focus of attention is on a particular job or order. A process cost accounting system is most appropriate when.

The assumption is that the cost of each unit is the same as that of any other unit so there is no. Process costing refers to a cost accounting method that is used for assigning production costs to mass-produced goods. A process costing system accumulates costs when a large number of identical units are being produced.

A process cost accounting system is most appropriate when a. Individual products are custom made to the specification of customers. Similar products are mass-produced.

Bthe focus of attention is on a particular job or order. A variety of different products are produced each one requiring different types of materials labor and overhead. A variety of different products are produced each one requiring different types of materials labor and overhead.

The focus of attention is on a particular job or order. Similar products are mass-produced. Similar products are mass-produced.

Individual products are custom made to the specification of customers. A variety of different products are produced each one requiring different types of materials labor and overhead. It helps management in decision making.

A process cost accounting system is most appropriate when a. Under this concept costs are accumulated over a fixed period of time. The focus of attention is on a particular job or order.

A variety of different products are produced each one requiring different types of materials labor and overhead. A process cost accounting system is most appropriate when. When companies produce uniquely different products.

A job can involve several processes. When is a process cost accounting system most appropriate. Individual products are custom made to the specification of customers.

A variety of different products are produced each one requiring different types of materials labor and overhead. This concept is useful in. Similar products are mass-produced.

A process cost system is used when each finished unit isindistinguishable from another. Similar products are mass-produced. Asked Jan 29 in Business by Miaka.

Individual products are custom made to the specification of customers C. Process costing is used when there is mass production of similar products where the costs associated with individual units of output cannot be differentiated from each other. In other words the cost of each product produced is assumed to be the same as the cost of every other product.

When a variety of different products are produced each one requiring different types of. Up to 256 cash back 1. A variety of different products are produced each one requiring different types of materials labor and overhead.

Up to 25 cash back 78 A process cost accounting system is most appropriate when A. The focus of attention is on a particular job or order. In this situation it is most efficient to accumulate costs at an aggregate level for a large batch of products and then allocate them to the individual units produced.

A process cost accounting system is most appropriate when a. For example the painting process would have workers labor paint and supply costs as well as rent and utility costs associated with it. The companies are not real Pros and Cons of Process Costing.

Individual products are custom made to the specification of customers. A process cost accounting system is appropriate for homogeneous products that are continuously mass produced. Similar products are mass-produced.

A variety of different products are produced each one requiring different types of materials. Process cost allows an organisation to assigns the cost to different steps in the production phase. The process cost accounting system looks at the different steps in each process and allocates costs to them.

Take a look at a few examples of how it works in these fictional companies. Individual products are custom made to the specification of customers. A process cost accounting system is most appropriate when.

Companies that produce soft drinks motion pictures andcomputers chips would all use process cost accounting. The focus of attention is on a particular job or order. Learn about the definition real-world examples and steps in.

For certain types of manufacturers process costing is the most practical and efficient accounting method for determining product. Process cost accounting is used in circumstances where the units of product are homogenous. For instance large manufacturing companies that mass-produce inventory might use process costing to calculate the total amount of direct and indirect costs associated with products that are completed and left in-process at the end of a.

Individual products are custom made to the specification of customers. When mass-produced products are manufactured that are very similar in nature. Similar products are mass-produced.

Similar products are mass-produced. The focus of attention is on a particular job or order. Process costing is a system of allocating production expenses of comparable products at each stage of the manufacturing process.

Cost accounting is a process of assigning costs to cost objects that typically include a companys products services and any other activities that involve the company. Similar products are mass-produced.

Acc 560 Wk 3 Quiz 2 All Possible Questions Quiz Quiz Me Cost Accounting

Cost Accounting Ca Is A Formal System Of Accounting For Costs In The Books Of Accounts By Means Of Wh Cost Accounting Accounting And Finance Financial Analysis

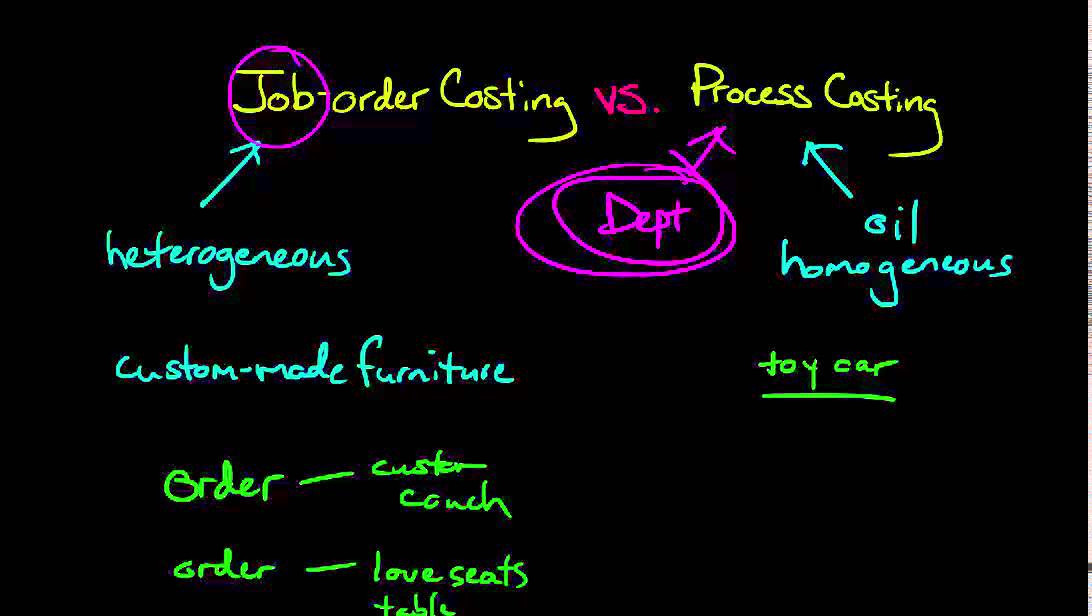

Tsedenya Gebreyesus In This Video He Explains And Goes Into Details About The Differences Of Job Order Costing And Process Costing He Job Relatable Process

Acc 560 Wk 3 Quiz 2 All Possible Questions Quiz Quiz Me Cost Accounting

Comments

Post a Comment